PNA Annuity Plans

Save money for your future at a high rate of return

This tax-favored plan allows you to save money for your future at a high rate of return while enjoying the benefits of tax-deferred earnings. The PNA offers two IRA accounts–Traditional and ROTH, and a Tax-Deferred Annuity account.

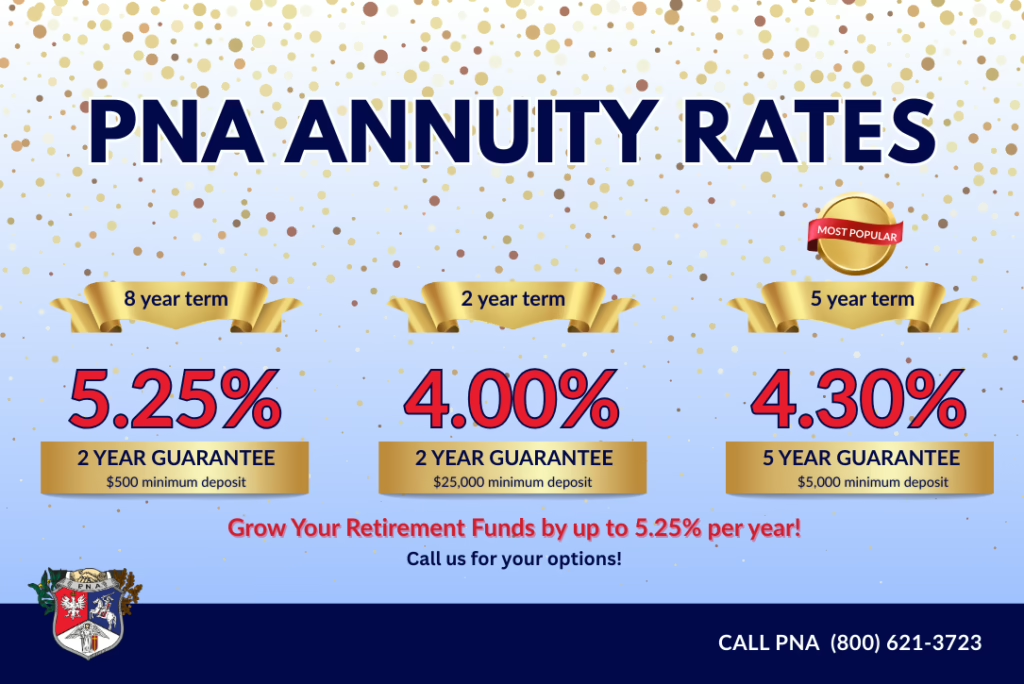

Get up to 5.25% on your new PNA annuity account today!

Call PNA at

1-773-286-0500

1-800-621-3723

Do you have an annuity at PNA?

An annuity at PNA can be the source of your retirement income. The sooner you open your annuity at PNA, the more time you’ll have to grow your money. An annuity can be a smart ‘retirement account’ choice, especially, during times of market turbulence. With guaranteed returns and no fear of losing money in the stock market, an annuity provides peace of mind that your retirement savings are secure. Plus, with tax season just around the corner, investing in an annuity is a smart way to be proactive with your finances.

At PNA, we are dedicated to helping our members achieve their financial goals and secure their futures. Our new, high rates on annuity accounts are just one way we’re making it easier than ever to save for retirement.

Contact us today to learn more about our annuity options and start earning guaranteed returns on your investment.

Why purchase an annuity from PNA?

- You have reached the age when you are no longer accumulating assets but now are using your assets to provide retirement income. You have gone from the accumulation phase to the distribution phase.

- You have done well with your money in the equity markets and now want to protect what you have earned.

- Tax-deferred build up is a valuable characteristic of the annuity product. Tax advantaged distribution is also beneficial.

- Annuities are an insurance product and, as such, can guarantee an income stream that you cannot outlive.

- A strategy that is becoming increasingly popular is to use the annuity to provide guaranteed income streams as a hedge against return risks from other assets.

- The financial strength of your insurance company is important. According to the results of a study by Standard Analytical, Inc., PNA’s financial results at the end of 2023 “compared favorably” to the aggregate averages of the top 25 life insurance companies.

Build Your Retirement with PNA !

Are you worried about market volatility affecting your retirement savings? The Polish National Alliance has a solution. Our new, high rates on annuity accounts offer a safe and secure way to save for retirement, with the potential to earn up to 5.25%. Choose one of three PNA Annuity accounts. Let our Annuity Department answer all the questions you may have. Decide which annuity account is the one for you and start building your retirement!

Unlike an IRA, you are not limited to a maximum yearly deposit.

The PNA tax-deferred annuity is available to all–regardless of age or health, whether employed or not.

No, there are no maintenance or service fees.

Common annuity and IRA plan questions

PNA deferred annuities and IRA plans are designed to be simple and easy to understand. If you are considering getting one and have questions, feel free to reach out to a PNA agent for more information today.

Call 773-286-0500 or 1-800-621-3723 ext. 331 for Polish,

ext. 365 for English.